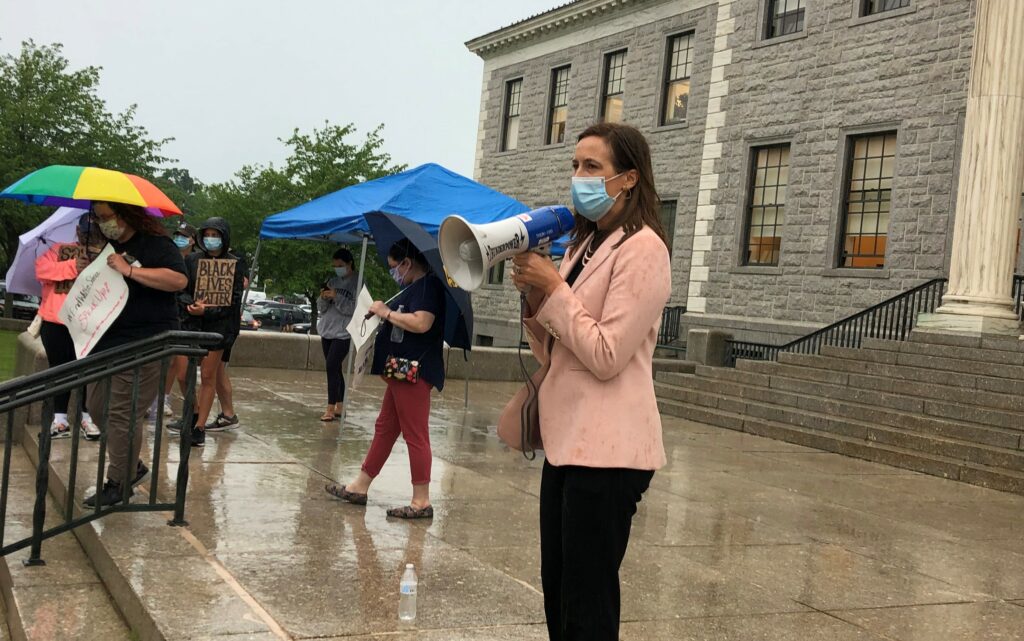

Sherrill Versus Sanders

Mikie Sherrill and her House colleagues from New Jersey and New York have some muscle and when it comes to SALT, they plan to use it.

“We will not vote for any bill that doesn’t include fixing the state and local tax deduction cap,” the congresswoman said at a virtual town hall meeting Tuesday night.

The House last week passed sweeping legislation known as Build Back Better that raises the $10,000 deduction cap on state and local taxes to $80,000, thereby giving relief to many middle-class families in New Jersey who pay more than $10,000 in property taxes alone.

This has been a goal of New Jersey Democrats – and even many Republicans – since the cap was created in 2017.

But the game is far from over.

The Senate has to pass the bill and Bernie Sanders says he thinks raising the cap would be too beneficial to the rich. In a 50-50 Senate, Democrats can’t lose even one vote.

So Sherrill was asked by a constituent what the House would do if the Senate stripped changes to the SALT cap from the bill. If the Senate changes the bill in any way, it comes back to the House for another vote.

Sherrill said if the SALT cap initiative is changed, she and a handful of like-minded House members would vote “no,” This would be more than mere symbolism. The Democrats’ margin in the House is so slim, they can’t afford to lose many votes. It’s a given that all House Republicans would vote no on Build Back Better.

In theory, this could put Sherrill and other New Jersey House members in the position of stopping a key part of the Biden Administration. Build Back Better supports many longstanding Democratic goals regarding childcare, Medicare expansion, education and fighting climate change.

Obviously, the hope is that the Senate, mindful of the leverage some House members have, will leave changes to the SALT cap in place.

Sanders hasn’t been the only voice decrying changing the SALT cap as a giveaway to the wealthy.

Sherrill disagrees, noting that the $10,000 deduction cap amounts to “double taxation.”

She also points out, as many in the state have noted for years, New Jersey deserves relief, because its residents contribute far more to the federal treasury in taxes than they get back in aid from Washington.

Leave a Reply