A Sweeney Ransom Note, or ‘Pirates of the Plebeian’

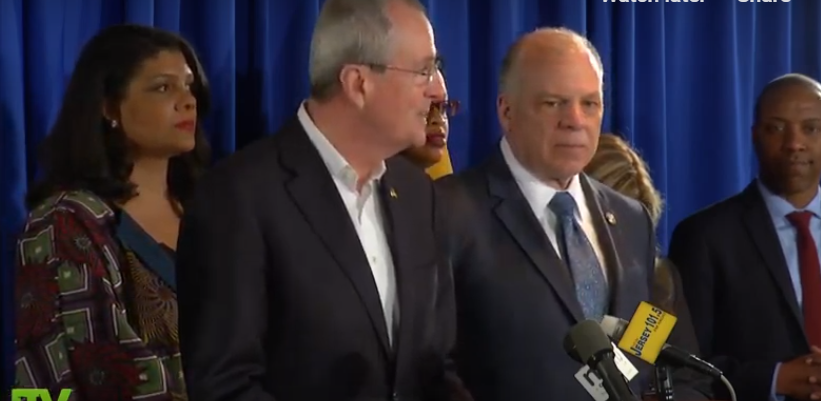

When Senate President Steve Sweeney (D-Gloucester) indicated his willingness to support a millionaire’s tax in return for an additional $1 billion contribution to the public employee pension system, the political/media chattering class immediately and confidently interpreted his remarks as evidence of a thaw in the relationship between the Senator and the Administration, an initial step toward a compromise that will lead to the fulfillment of Gov. Phil Murphy’s three-year quest to raise taxes on the wealthy.

The celebration may be a bit premature, however, a mix of wishful thinking and excessive optimism — a belief that, at last, hope will triumph over experience.

That wasn’t an olive branch Sweeney handed the governor; it was a ransom note: “Put one billion dollars in unmarked bills in a briefcase, deposit it in the pension fund and the millionaire’s tax will be released unharmed.”

It was a straightforward, blunt example of the transactional politics which control the state budget process. For fans of government transparency, it doesn’t get much clearer than this — a deal made on the front page.

While Sweeney’s professed openness to increasing the tax on incomes above $1 million a year does represent a slight shift from his hard-line opposition, it was tempered by his negative reaction to the rest of the governor’s $1 billion tax and fee increase agenda.

Equally ominous was the response of Assembly Speaker Craig Coughlin (D-Middlesex) that the Legislature should proceed with great caution when dealing with any increase in broad-based taxes.

It is Murphy’s play now. While he acknowledged Sweeney’s offer, it will be difficult in the extreme for the Administration to shake loose another billion dollars for the pension fund to meet the Senator’s conditions.

The anticipated revenue from the proposed tax increases is already included in his budget and if they are rejected in whole or in part by the Legislature, it will require significant spending cuts or abandoning the new or expanded programs he’s recommended.

Sweeney’s been clear in his demand that the billion dollars is over and above the $4.5 billion pension fund payment in the proposed $40 billion budget.

He’s been outspoken in warning that continuing to increase spending while shortchanging the pension fund has placed the state in an unsustainable position – a “death spiral” he characterized it at one point.

His offer to swap the millionaire’s tax for the additional pension fund appropriation is a politically solid move for him.

If the governor rejects the idea or is unable to meet the demand, Sweeney emerges as a responsible leader committed to shoring up a pension fund saddled with a staggering unfunded liability burden.

If somehow the Murphy Administration can scrape together the billion dollars or suggest a viable path to reach it, Sweeney can take credit for single-handedly rescuing the system and guaranteeing future retirees their benefits have been saved.

There is little political risk for Sweeney in blocking the millionaire’s tax. He and Coughlin have done it twice before and emerged unscathed, even when the stalemate drove the state to the brink of a shutdown.

Murphy has repeatedly driven the message that a millionaire’s tax enjoys upwards of 70 percent support and would be of insignificant impact on high income earners.

It would, he argued, require some 22,000 taxpayers to ante up an additional two cents on every dollar over $1 million. Sweeney and Coughlin were unmoved by the same arguments in 2018 and 2019 and there’s no indication it will be any more telling now than then.

The potential for achieving a compromise exists, slender as it may be.

Murphy, for instance, could seek to phase in the additional billion dollars over two budget cycles rather than in one chunk.

He could also agree to accept some of Sweeney’s recommendations for reforms in the pension and health benefits system, including shifting from a defined benefits plan to a version of a 401(k) system and reducing the medical insurance plan from the top platinum tier to the second gold level.

Murphy has stoutly resisted any change, however, but the lure of becoming the governor who restored solvency to the pension fund may overcome his promise to public employee unions to protect their existing benefits.

The budget drama will, as always, play out for the next four months, but understanding that Sweeney will likely not budge from his position, it is the governor who will confront the hard and politically fraught decisions.

Sweeney clearly does not fear any consequences from rejecting the millionaire’s tax and history is on his side.

Several years ago, a moderately successful author was asked what type of writing he found to be the most financially lucrative.

“Ransom notes,” he replied. Seems like Sweeney saw the interview.

Carl Golden is a senior contributing analyst with the William J. Hughes Center for Public Policy at Stockton University.

Just checking to confirm that my new account is working.